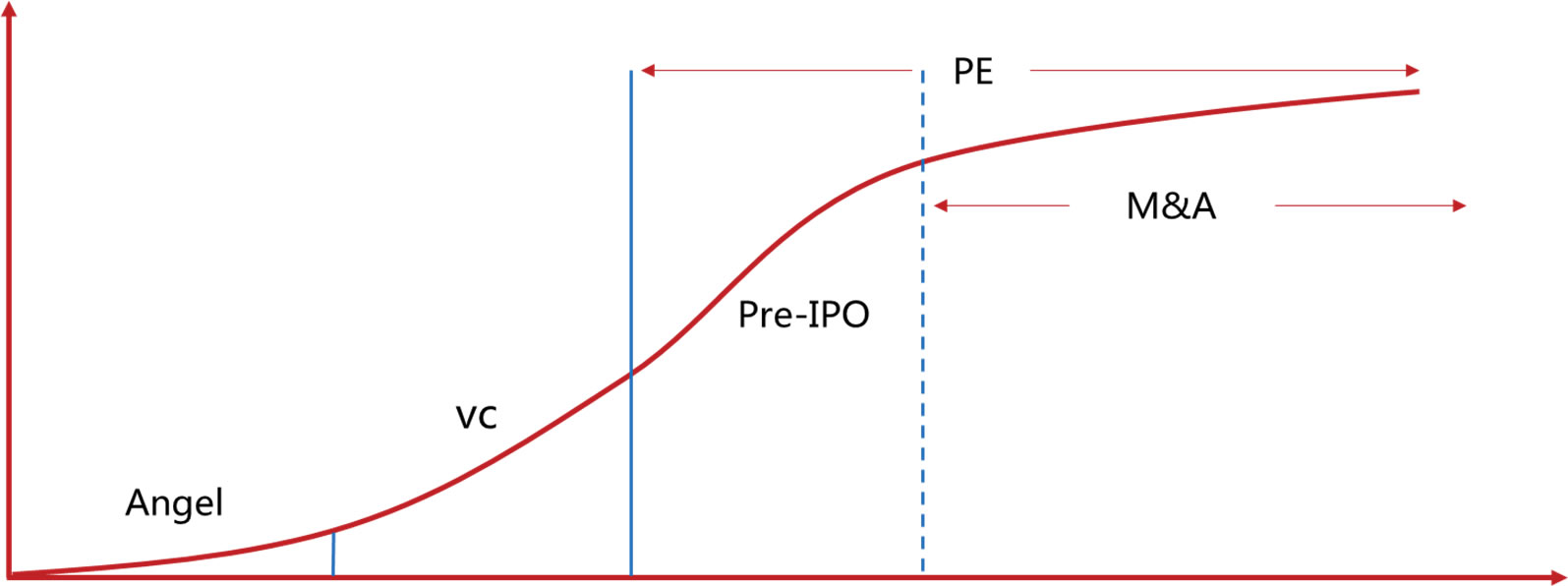

Pre-IPO Fund

Advantages of Pre-IPO project investment: short investment cycle

|

||||

|

8 Years

|

5 Years

|

3 Years

|

||

Advantages of Pre-IPO project investment: clear exit strategy

|

PARTNER OF CHOICE FOR OPPORTUNITIES FROM CHINA'S INTERNATIONALISATION |

|

STOCK CONNECT WITH ACCESS TO MAINLAND CHINA INVESTORS FUNDED JUMBO IPOS |

|

DIVERSE AND GLOBAL INVESTOR BASE |

|

INTERNATIONAL CORPORATE GOVERNANCE STANDARDS |

|

HEALTHY AND ROBUST SECONDARY MARKET |

|

INTERNATIONAL CORPORATE GOVERNANCE STANDARDS |

|

FRAMEWORK FOR CORNERSTONE INVESTORS |

|

SOUND REGULATORY REGIME |

|

TRANSPARENT PROCESS |

|

WELL ESTABLISHED LEGAL SYSTEM |

Pre-IPO Investment Fund Decision Mechanism

Decision process

| Project acquired |

|

Set up project committee |

|

Clear focus |

|

Internal committee |

|

Investment committee |

|

Fund investment decision committee |

Pre-IPO Investment Fund Risk Control

| Risk sharing, risk control |

|

First protection Hua liang and its related parties will participate, with same share same right, to achieve a win-win situation. |

|

6 confident levels ① Bank custody: commercial bank custody to ensure the safety of funds; ② Scientific decision-making: Strict implementation of the investment and risk control committee approval system; ③ Mature project: Pre-IPO companies are mostly mature projects, which are more standardized after brokerage, accounting and lawyer counselling; ④ Reasonable pricing : strictly control the investment price at no more than 10 times PE; ⑤ Investment protection: Fully involve in business operation to assure IPO exit; ⑥ Exit: Distribute returns after exit; |